full service

We will assist you with Buying and Selling your property.

Frequent updates

We will always update you during your transaction.

Post transaction

Call me for questions on your new home or to just talk story!

technology

Real Estate and Technology go well together.

About us

The Real Estate industry is heading full speed ahead into the digital world, and Buyers and Sellers will find it highly advantageous to have someone with the knowledge and expertise in using state-of-the-art technology combined with up-to-date real estate expertise.

A few things we’re great at

With our assistance, you will accomplish your Real Estate goals. Whether you need to Sell or Buy, or just need some answers, we’re here for you.

sell

Selling Real Estate involves many complex steps. We will help you navigate each step of the way!

buy

Buying Real Estate involves many complex steps. We will be with you and guide you to finding your dream home!

consult

Every Real Estate property is unique. We can answer your questions or lead you to a professional who will.

enjoy

After you place all of the pieces of your Real Estate project together, you can enjoy your accomplishments!

The secret of success

Focus on the things that matter most to you. If you’re looking for your dream home, we can help you find it. Do you need help with your home after your purchase, we can help you with that too!

lifestyle

Live the life you’ve been dreaming about. Do the things that bring you joy and happiness!

work

Are you working in the office or transitioned to working from home?

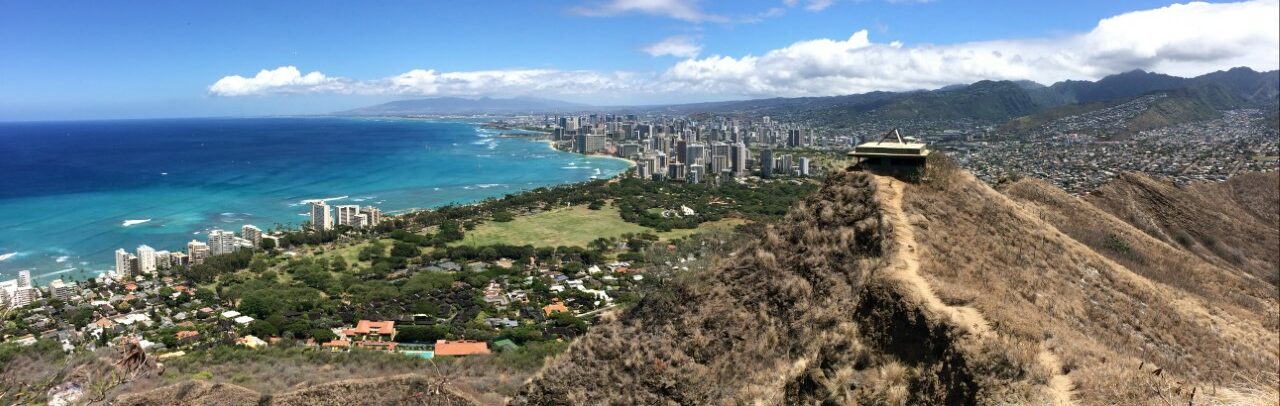

play

Hawaii’s fabulous weather year-round lets you enjoy the outdoors practically everyday!

dreams

Pursue your dreams living in one of the best places on this planet. Start today!